tax deductible expenses malaysia

The following income categories are exempt from income tax. 1 Leave Passage Vacation time paid for by your employer in two categories.

How To File Income Tax For Your Side Business

Medical expenses for serious diseases for self spouse or child.

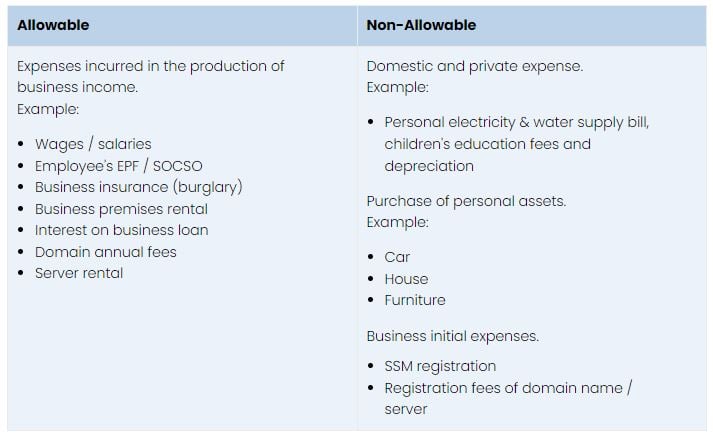

. Corporate income tax deduction is allowed for expenses wholly and exclusively incurred in the production of income. Rent expenses of business premises repair and maintenance of premises plant and machinery loan interest or borrowing. Under section 331 of the Income Tax Act 1967 ITA all outgoings and expenses wholly and exclusively incurred during a specified period by the business in the production of.

Medical expenses for serious diseases for self spouse or child including vaccination. The amount deductible is equivalent to the amount charged by JSM. S33 4 and 5 interest.

Medical expenses for fertility treatment for self or spouse. These are the types of personal reliefs you can claim for the Year of Assessment 2021. Up to RM2500 for self spouse or child.

According to LHDN they include. S33 1 general deductibility of expenses. F Expenditure incurred in establishing and managing a musical or cultural group.

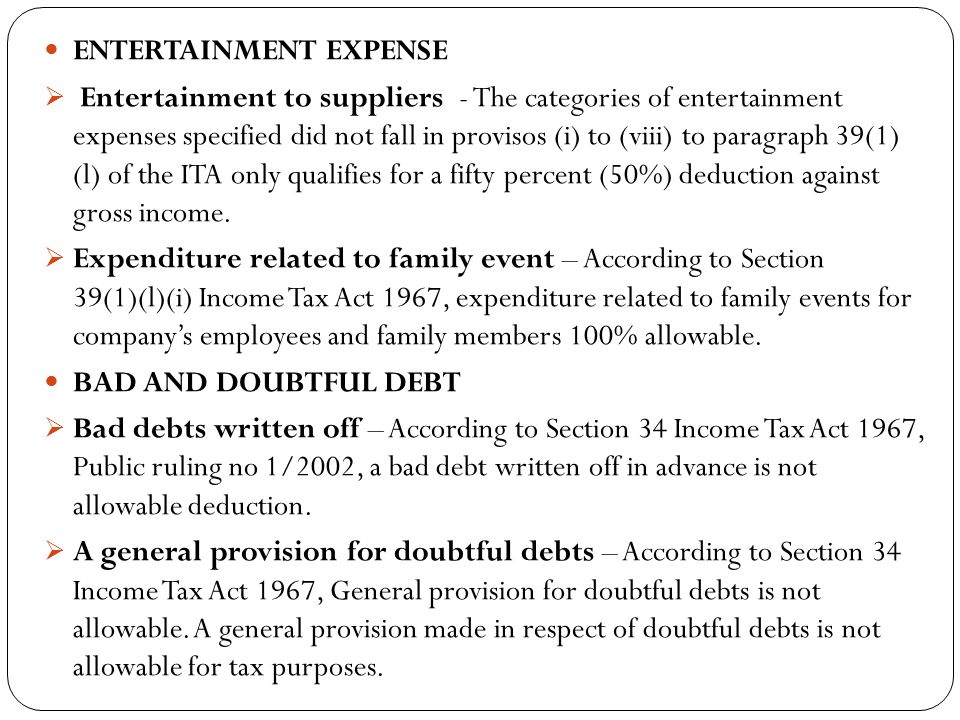

19 rows Employees are allowed a deduction for any expenditure incurred wholly. The deduction is limited to 10 of the aggregate. Expenses on free meals refreshment annual dinners outings.

Assessment tax Quit rent Interest on home loan Fire insurance premium Expenses. Employee Benefits That are Tax Deductible Employers Tax Exempted Employees. Tax Clearance Form CP21 CP22A CP22B.

This Statement of Remuneration Paid shows employment income and tax deducted during the previous year as well as several other items. Malaysia 2022 Budget Highlights. Parking Fee Allowance Limit to reasonable amount Official Travelling.

Deductible legal and professional expenses This Ruling addresses the specific situations when and how legal and professional expenses may be deducted as an expense under subsection. So what are these deductible expenses for rental income. Keep ahead of the.

E Expenditure incurred in providing and maintenance of a child care center for the benefit of employees. Tax Deductible Expenses For Company In Malaysia 2022. The deductible expenditure is the current basic fees fees charged by JSM before and after the issue of.

S33 1 a specific deductibility of interest expense. Complete medical examination for self. For small and medium enterprise SME the first RM600000 Chargeable Income will be tax at 17 and the Chargeable Income above RM600000 will be tax at 24.

The below are some expenditures generally deductible for tax. In general medical fee for the employee is tax-deductible under S 33 of the Income Tax Act 1967. At least 45 penalty on tax avoidance according to paragraph 113 2 of ITA To sum up it is crucial that you are well aware of the ongoing changes in the withholding tax in.

You can claim for expenses spent on tourist accommodation charges and entrance fees to tourist attractions for. A deduction is allowed for cash donations to approved institutions defined made in the basis period for a year of assessment. Is directors medical expense tax-deductible in Malaysia.

Some of the most prominent deductible corporate expenses include. Salary and wages Business insurance. Box 44 of this slip reports union dues paid.

LEGAL and professional expenses are deductible under the Income Tax Act 1967 ITA when they are incurred in the maintenance of trade rights or trade facilities existing or alleged to exist. As we used to say staff are assets and therefore the expenses are tax deductible. Start-up costs Operating expenses Advertising expenses Salaries and bonuses Expenses for the employee medical.

The provisions relating to the tax treatment of interest expense are.

Business Related Travel Expenses Are Deductible Wolters Kluwer

Simple Tax Guide For Americans In Malaysia

Problem Based Learning Project Tax Computation On Malaysian Food Service Mfs Sdn Bhd Group B Namematrik No Izwani Bt Abdul Majid Hazwani Bt Ghazali Ppt Download

Special Tax Deduction On Rental Reduction

Income Tax Malaysia General And Specific Deductions Pdf Expense Tax Deduction

What Bloggers Influencers And Freelancers Need To Know About Taxes In Malaysia Blogjunkie Net

Working From Home Your Home Offices Expenses Are Probably Not Tax Deductible

9 Common Business Expense Mistakes U S Freelancers Make Freshbooks Blog

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

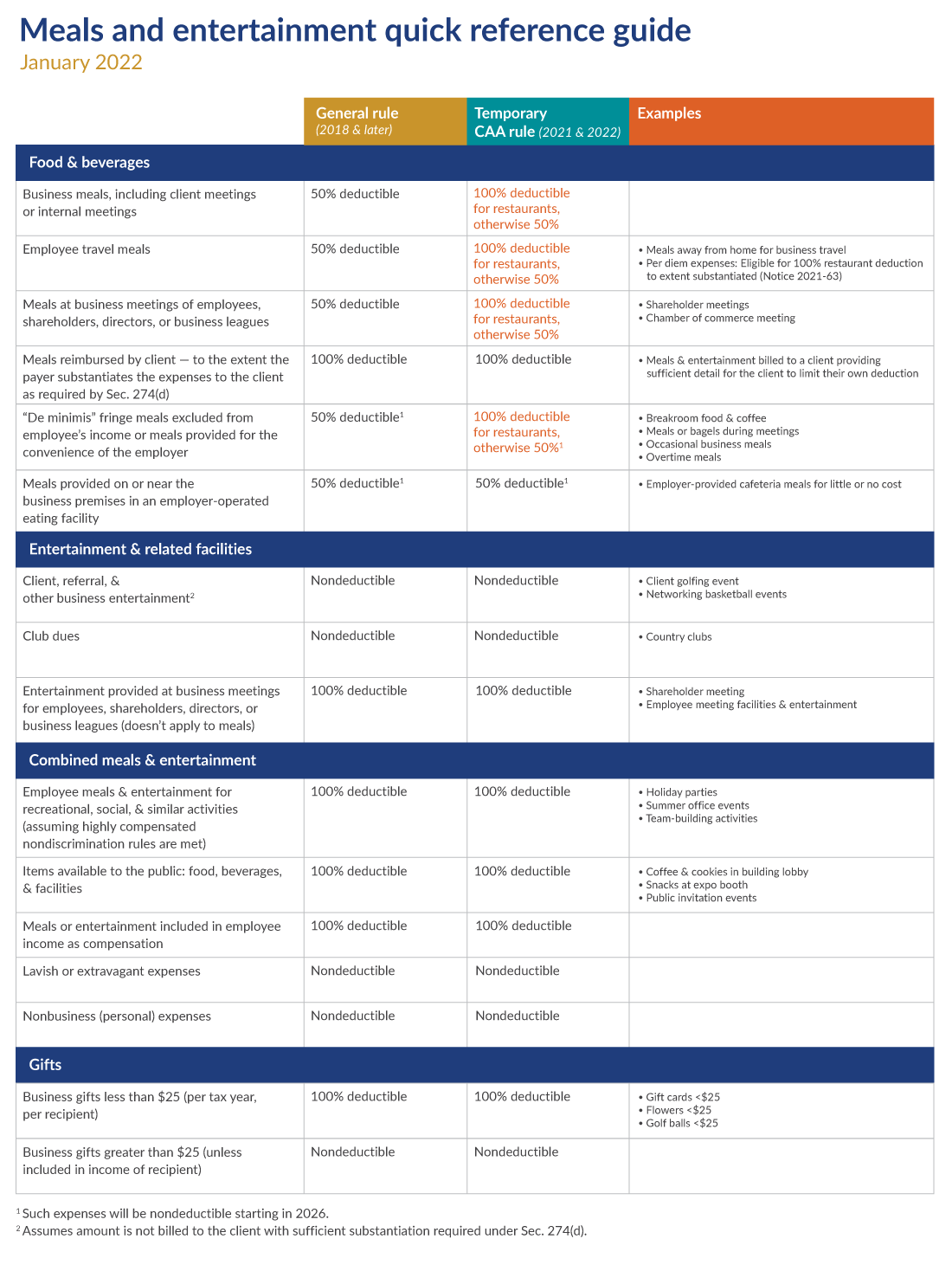

Expanded Meals And Entertainment Expense Rules Allow For Increased Deductions Our Insights Plante Moran

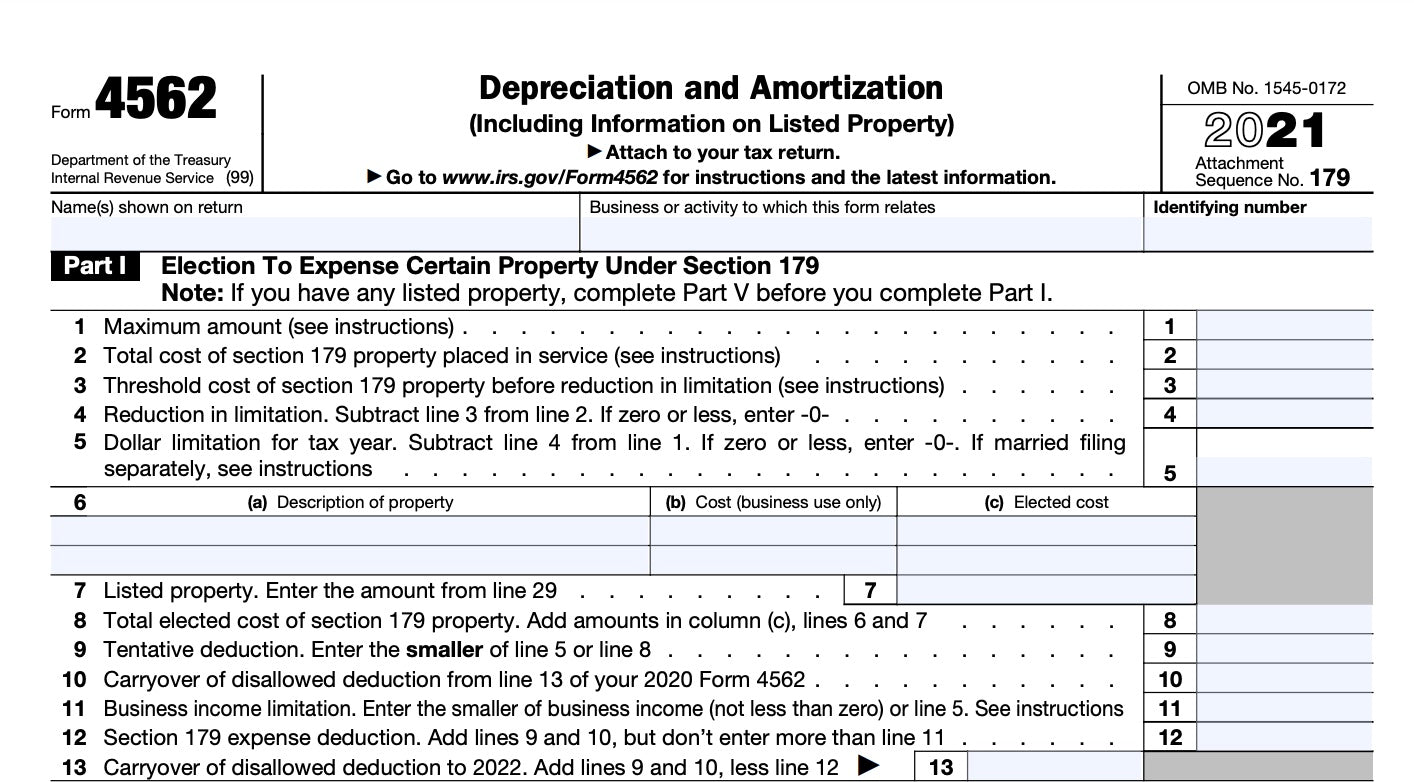

Section 179 Tax Deduction How It Works For Retailers 2022 Shopify Indonesia

:max_bytes(150000):strip_icc()/CreatingaTax-DeductibleCanadianMortgage1_3-bbe7be25ea614913b8e8351756c52239.png)

Creating A Tax Deductible Canadian Mortgage

Newsletter 40 2019 Income Tax Deductions For The Employment Of Disabled Persons Amendment Rules 2019 Page 001 Jpg

Solved Please Note That This Is Based On Philippine Tax System Please Put Course Hero

Tax Treatment On Entertainment Expenses Asq

10 Tips For Deducting Your Health Care Expenses

Pdf Tax Simplicity And Small Business In Malaysia Past Developments And The Future Semantic Scholar

What Are Non Deductible Expenses In Business

Ks Chia Tax Accounting Blog How To Maximise Your Entertainment Expenses Deduction

0 Response to "tax deductible expenses malaysia"

Post a Comment